Coastal Ecosystem Projects Drive Premium Carbon Market Growth

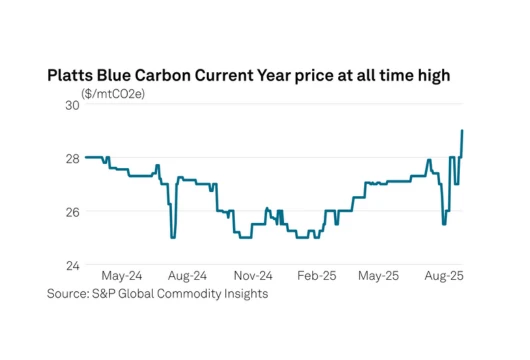

The price of blue carbon credits has surged to record highs, signaling the arrival of a new era in global carbon markets where coastal and marine ecosystems are becoming pivotal tools for climate action. According to Platts, the DBC-1 benchmark price climbed to $29.30 per metric ton of CO₂ equivalent (mtCO₂e) on August 28, 2025, marking the highest level since the benchmark’s launch in March 2024.

This milestone reflects a fundamental shift: demand for blue carbon credits is now far outstripping supply. Corporations, governments, and investors are seeking high-integrity, high-impact offsets tied to mangroves, seagrass beds, and salt marshes — ecosystems that act as some of the planet’s most effective carbon sinks.

Why Blue Carbon Credits Are in Demand

The sharp rise in blue carbon credit prices is no accident. Multiple forces are driving this trend:

- Corporate climate targets: With net-zero commitments becoming mainstream, companies are actively seeking premium offsets to complement their decarbonization strategies. Blue carbon projects, which deliver both carbon and ecological benefits, are increasingly seen as the “gold standard” of offsets.

- Policy support: Governments in Southeast Asia, Africa, and Latin America are integrating coastal ecosystem protection into their national climate plans. This has encouraged private sector financing and accelerated project pipelines.

- Market credibility: In a voluntary carbon market where greenwashing is a growing concern, blue carbon stands out. Buyers value the third-party verified, science-backed nature of these credits, which also deliver biodiversity and community benefits.

As a result, DBC-1 credits now command higher premiums than most traditional forest-based offsets.

Nature’s Superpower: The Role of Coastal Ecosystems

What makes blue carbon unique is the natural efficiency of coastal ecosystems. According to the UN Environment Programme, mangroves and seagrass can capture carbon up to four times faster than terrestrial forests, storing it in soils and sediments for centuries.

Currently, these ecosystems sequester an estimated 0.5 to 1.0 gigatonnes of CO₂ annually. Yet degradation from coastal development, pollution, and deforestation leaves vast potential untapped. Restoration efforts could allow blue carbon projects to offset up to 3% of global emissions by 2030 — a meaningful contribution to climate goals.

Beyond carbon, blue carbon projects also:

- Protect biodiversity hotspots.

- Strengthen coastal resilience against erosion and storms.

- Support fisheries and enhance food security.

- Provide sustainable livelihoods for local and Indigenous communities.

Why Supply Struggles to Keep Up

Despite skyrocketing demand, supply remains severely constrained. The current issuance of blue carbon credits is estimated at fewer than 10 million mtCO₂ annually — a fraction of the hundreds of millions needed to meet corporate demand.

Challenges slowing project development include:

- Land tenure complexities: Rights over mangrove forests and coastal zones are often unclear.

- Regulatory uncertainty: Countries are still shaping carbon accounting rules and coastal protection policies.

- Long verification timelines: Ensuring high-integrity, third-party certification can take years.

- Capacity and funding gaps: Many coastal nations lack resources to scale up projects.

This structural imbalance between supply and demand is the primary driver of rising prices.

Financial Institutions and New Market Mechanisms

The rising value of blue carbon credits has attracted institutional investors, with new specialized funds financing restoration and conservation projects. These funds typically provide upfront capital in exchange for a share of future credit revenues, creating new pathways for scaling projects.

Meanwhile, standards bodies like Verra and Gold Standard are updating methodologies to better capture the full climate, biodiversity, and social co-benefits of coastal ecosystems. Additionally, the Paris Agreement’s Article 6 framework could open blue carbon projects to compliance markets, further boosting demand.

Signals for Key Stakeholders

- For Investors: Blue carbon is emerging as a premium asset class. Early entrants may benefit from long-term appreciation, though supply bottlenecks remain a constraint.

- For Companies: With costs rising, buyers may need to secure long-term offtake agreements to guarantee access to blue carbon credits.

- For Policymakers: Supportive regulations, land-use clarity, and financial incentives are essential to unlock project pipelines and scale this sector.

Blue Carbon’s Defining Moment

The record-high DBC-1 benchmark underscores a critical point: blue carbon is no longer a niche option — it is becoming central to global carbon markets.

If supply can expand, these projects could play a major role in climate mitigation, adaptation, and biodiversity protection, all while supporting local communities. Without it, blue carbon credits risk remaining a premium, scarce commodity accessible only to the highest bidders.

For now, the message from the market is clear: blue carbon credits are in demand, here to stay, and vital for a sustainable future.

For more in-depth analysis and inspiring climate news, click here.